COMBINING MACHINE LEARNING AND MATHEMATICAL OPTIMIZATION – Part 3

Article three of five

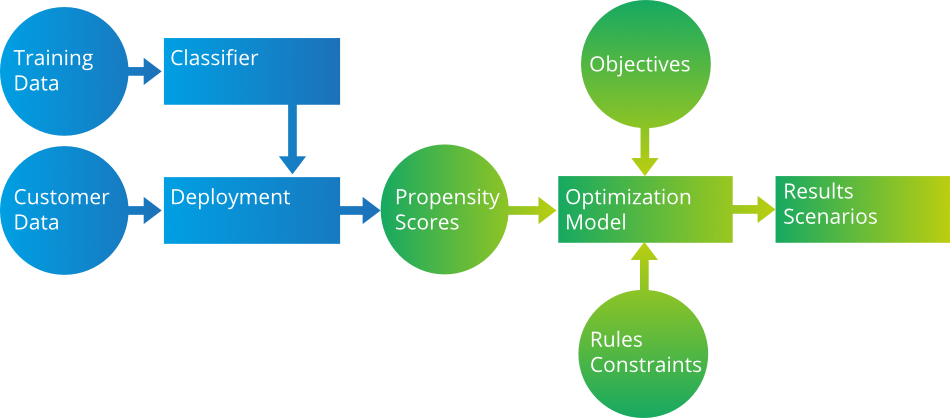

In our first article we identified four scenarios where Machine Learning can cooperate with Mathematical Optimization. In this article, we will consider Scenario A and present an example. Scenario A is defined as: ‘The output of ML is input to MOPT.’

This scenario is defined as:

Machine learning algorithms calculate the propensity of customers to use different offers/coupons/discounts, then the optimization algorithm assigns the offers to the customers and maximizes the total propensity score or other objective functions.

RETAIL BANK CASE STUDY

In this case study from the IBM Decision Optimization Hub a retail bank sold several products (mortgage account, savings account, and pension account) to its customers. It kept a record of all historical data, and this data is available to analyse and to reuse.

After a merger the following year, the bank has new customers and wants to start some marketing campaigns. The budget for the campaigns is limited. The bank wants to contact a customer and propose only one product.

The marketing department needs to decide:

- Who should be contacted and which product should be proposed? Proposing too many products is counter-productive.

- How will a customer be contacted? There are different channels with different costs and efficiency.

- How can they use the limited budget optimally?

- Will such campaigns be profitable?

Here are the predictive and prescriptive workflows:

From the historical data, we would train a machine learning product-based classifier on customer profile (age, income, account level, …) to predict whether a customer would subscribe to a mortgage, savings, or pension account.

- We then apply this predictive model to the new customer’s data to predict for each new customer what they will buy.

- On this new data, we decide which product is offered to which customer through which channel using an optimization model with IBM Decision Optimization.

- The solutions are displayed, compared, and analyzed.

This approach allows us to perform:

- Sensitivity analysis with budget constraints;

- Run simulations and create scenario for different objective functions;

- Visualize our results (both from the machine learning and optimization);

Furthermore, this pipeline can be generalized and applied in many other used cases such as:

- Insurance pricing

- Credit Management

- Collections Management

- Marketing Optimization

Cloud computing and powerful CPUs give the ability to solve large scale problems and automate this process much faster today and companies should take advantage of these capabilities.

To find out how your business can benefit from machine learning and mathematical optimization, contact the optimization experts at Optimization Direct.